RECURRING PAYMENTS

Automate your recurring credit card payments and relax.

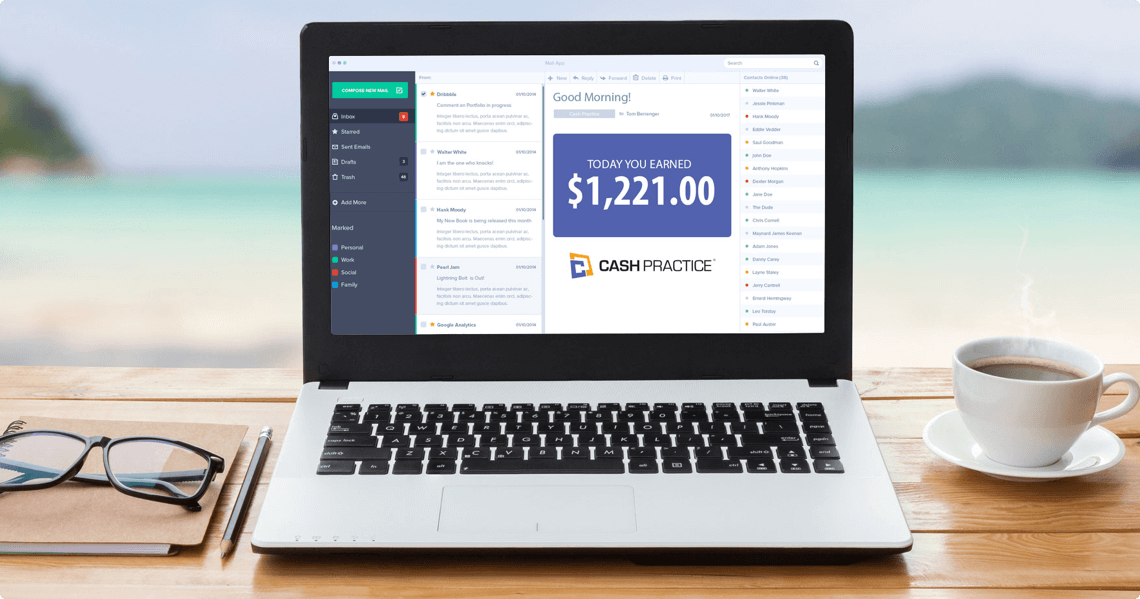

Auto-Debit Scheduler™ for Recurring Credit Card Payments Set it and forget it! That’s the power of using the Auto-Debit Scheduler to schedule all your recurring credit card payments. Once your recurring credit card payments are scheduled, all you have to do is sit back, relax and collect your revenue. Payments automatically process, whether it’s a holiday, a weekend, raining or you’re on vacation. Ahhhhh, it’s so relaxing!

ALL MAJOR CREDIT CARDS ACCEPTED

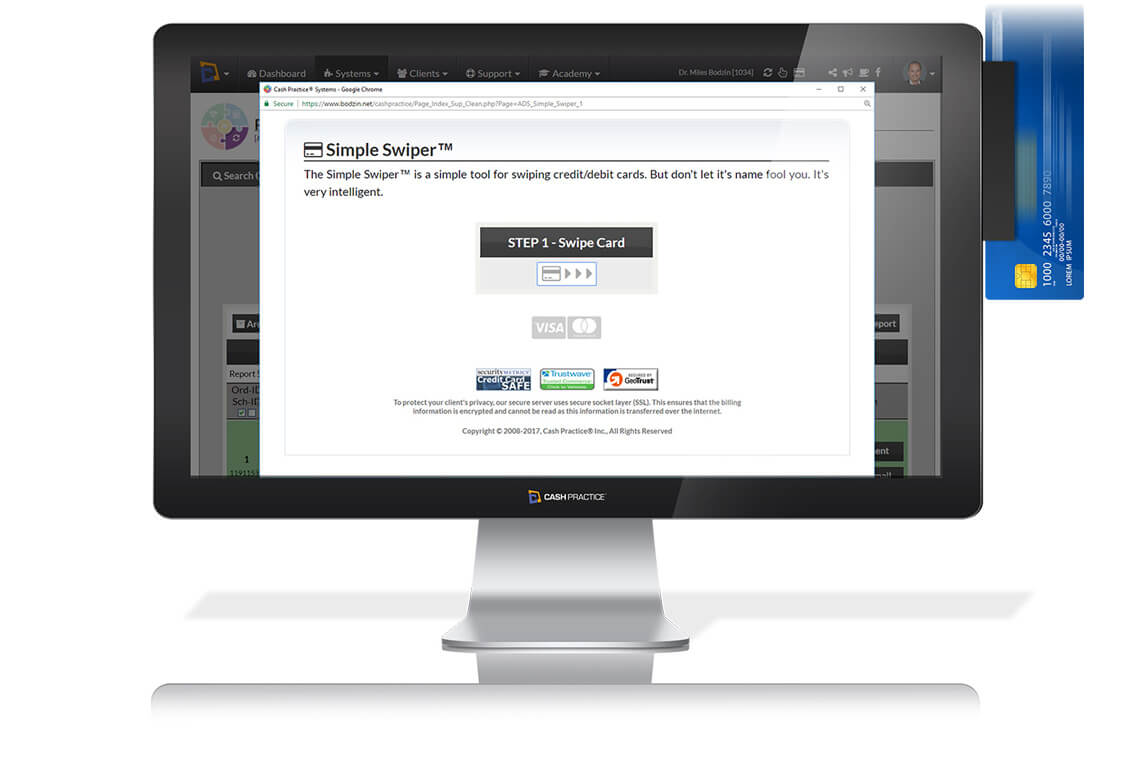

pos system

Credit-keyed and swiped transactions.

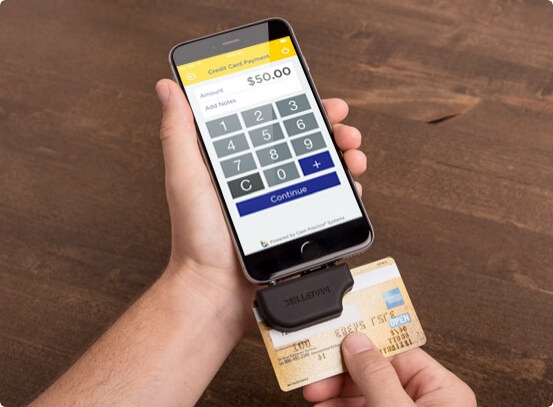

mobile payments, online forms and gift cards

Collect payments from anywhere.

analytics

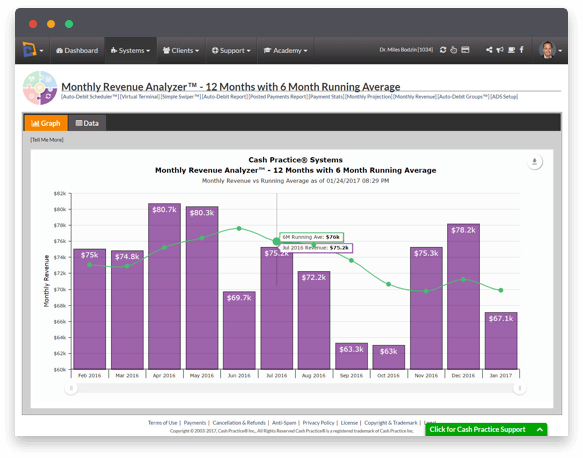

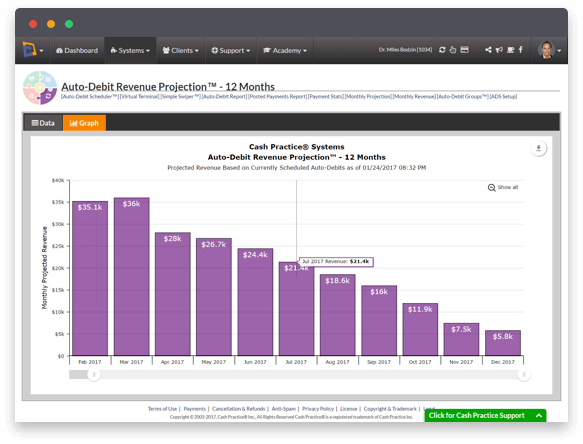

Get a snapshot of where your collections have been

and where they’re headed.

Easy to understand reports and charts giving you the information you need to grow your business.

SECURITY

Data security is on everyone’s mind these days.

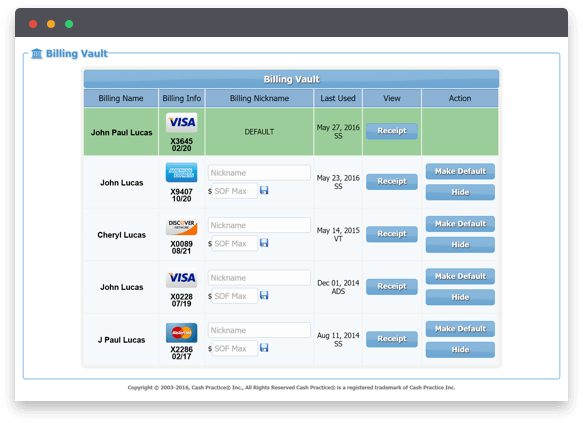

PCI DSS Payment Card Industry Data Security Standard (PCI DSS) has become one of the most important advances in the credit card industry and online security, and is required by Visa/MasterCard for all merchants handling credit cards. Not following these rules can result in fines to the merchant and processing privileges being suspended. Security Metrics, a VISA Qualified Security Assessor, has independently audited Cash Practice Systems and certified that Cash Practice Systems is PCI DSS compliant. Theft prevention Refunds can only be processed against an original transaction using the same card originally used. This prevents theft and loss by not allowing credits to be randomly applied to a credit card or bank account. In addition, members can create user accounts and define access control for staff members. For example, you may want to prevent a staff member from being able to do refunds or voids altogether. In addition, users can be limited to specific days and times for logging in.ADDITIONAL BENEFITS

The Auto-Debit System does so much more:

-

No contracts, cancellation fees or paperwork

Our merchant accounts have NO contract requirement or early termination fees whereas nearly all other merchant companies require at least a 3-year contract that subjects you to fees if you break the contract. The entire application is done online with no paperwork required for most applicants. -

Competitive rate analysis

Our merchant rates are very competitive. You’d have a hard time finding better rates with no long-term contract and no early termination fees. However, we’re happy to offer you a competitive rate analysis against any other offer you may have. -

In-house merchant services department

We do not pass our clients off to a third party to manage merchant accounts – like nearly every other software vendor. We have an in-house team dedicated to giving you the personal service you deserve. -

User permissions to protect you

Cash Practice Systems has an extensive list of User Permissions that allows the administrator to control what their Account Users are allowed to do and not do. For example, you can block users from doing refunds.

Join Cash Practice Systems today!

Start today for as little as $49/mo. Training is included.